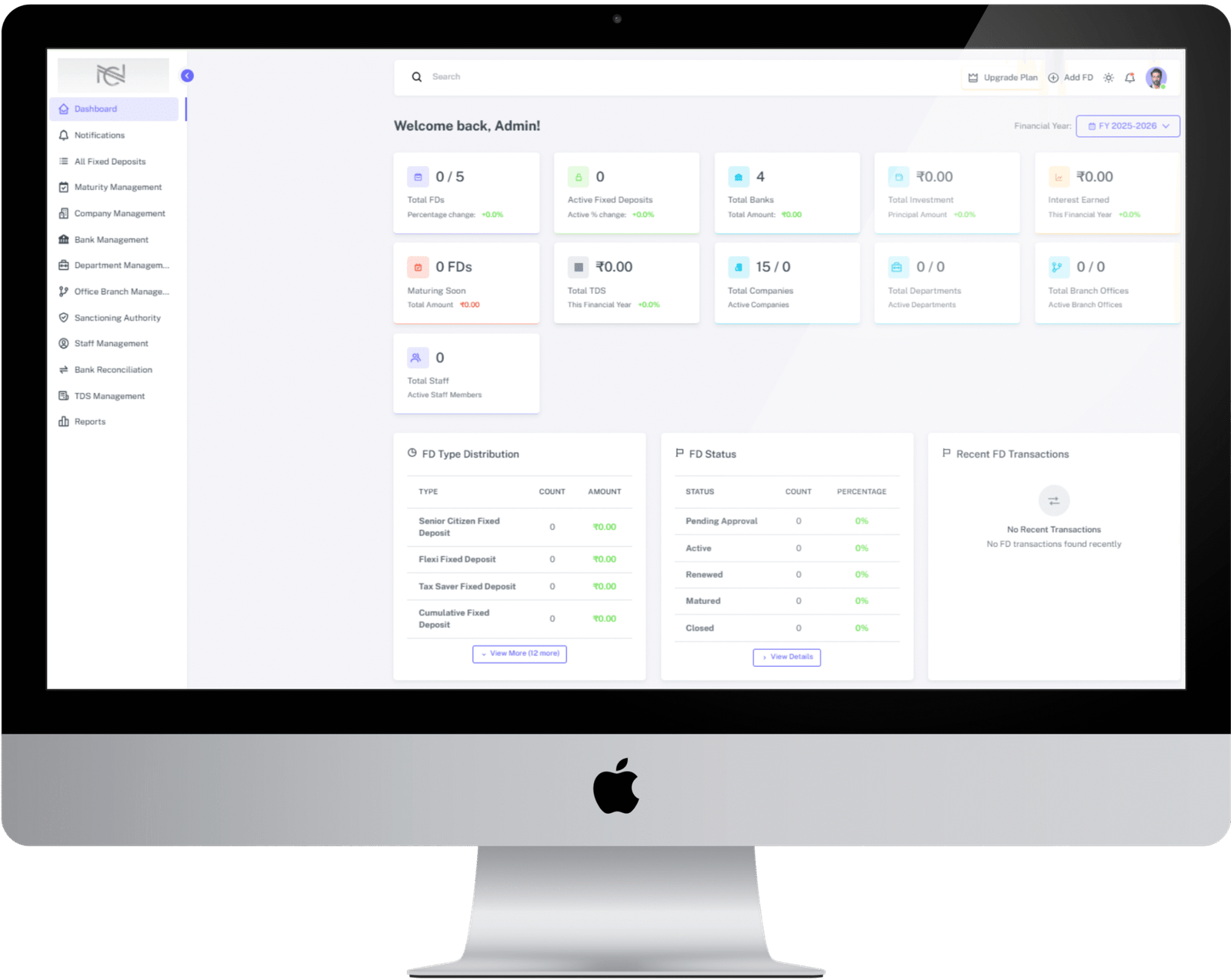

About Software

Smart, Secure, and Scalable Fixed Deposit Management

Our Fixed Deposit Management Software is a purpose-built solution designed to simplify the way organizations track and manage their fixed deposit investments. Whether you’re a corporate finance team, educational trust, hospital, or government body, the software empowers you with the tools to take full control of your FD portfolio with ease, precision, and compliance.

No more spreadsheet errors, missed maturity dates, or last-minute audit panic. This platform brings your entire FD lifecycle into one place — from investment creation and interest tracking to TDS compliance and document management.

Technical Highlights

-

Cloud-Based or On-Premise Deployment

-

Secure Login with Role-Based Access

-

Excel/PDF Export for Reports

-

Smart Document Uploads (FD Receipts, Bank Letters, etc.)

-

TDS Management with 15G/15H Support

-

API Available for Integration with Accounting or ERP Systems

What Makes It Different?

Centralized FD Tracking

Maintain a centralized dashboard of all fixed deposits across banks, branches, and departments.

Auto Interest Calculation

Automatically calculate interest (simple or compound) based on bank terms, rates, and maturity schedules.

Multi-Bank & Department Support

Track FDs department-wise and bank-wise, including issuer details, auto-renewal, and investment limits.

Maturity Alerts & Notifications

Get automatic alerts before FD maturity, renewal, or premature withdrawal deadlines.

TDS and Compliance Ready

Manage TDS deductions, generate Form 16A, and ensure compliance with financial and tax norms.

Premature Withdrawal Management

Handle early withdrawals with proper interest adjustment and documentation.

Custom Reports & Analytics

Export reports in Excel or PDF, filter by date, bank, or department – perfect for audits and MIS.

Secure Role-Based Access

Granular user roles and permissions to ensure only authorized access to sensitive financial data.